Multiple Choice

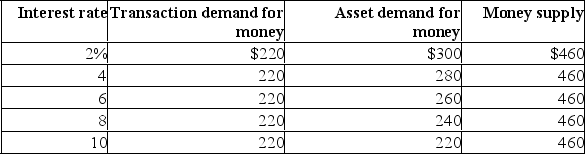

Assume that the desired reserve ratio is 10 percent and there are no excess reserves in the banking system.Also, suppose that the full-employment, non-inflationary level of GDP in this closed, private economy is $1,200.  Refer to the above information.An interest rate of 2 percent is not sustainable because:

Refer to the above information.An interest rate of 2 percent is not sustainable because:

A) the demand for bonds in the bond market will fall and the interest rate will fall.

B) the demand for bonds in the bond market will rise and the interest rate will fall.

C) the supply of bonds in the bond market will decline and the interest rate will rise.

D) the supply of bonds in the bond market will rise and the interest rate will rise.

Correct Answer:

Verified

Correct Answer:

Verified

Q77: All else equal, an expansionary monetary policy

Q78: Suppose the Bank of Canada sells $2

Q79: If during a certain period the Bank

Q80: Monetary policy is subject to less political

Q81: Lower bond prices reduce interest rates.

Q83: Which of the following will not happen

Q84: All else equal, when the Bank of

Q85: Which of the following is an expansionary

Q86: The major purpose of the Bank of

Q87: Assume that a single chartered bank has