Essay

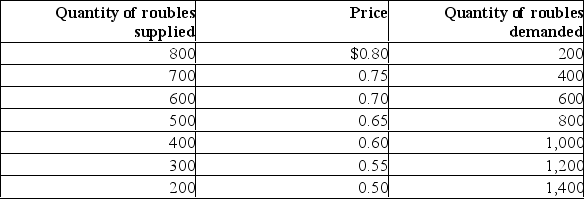

In the table below are the supply and demand schedules for Russian roubles.  (a) What will be the rate of exchange for the Russian rouble and for the Canadian dollar? (b) What would happen if the Canadian and Russian governments wanted to use currency intervention to fix or "peg" the price of a rouble at $0.60?

(a) What will be the rate of exchange for the Russian rouble and for the Canadian dollar? (b) What would happen if the Canadian and Russian governments wanted to use currency intervention to fix or "peg" the price of a rouble at $0.60?

Correct Answer:

Verified

(a) A Russian rouble will cost...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: What domestic macroeconomic adjustments would be necessary

Q12: What happens in the foreign exchange market

Q13: Describe the three major disadvantages of flexible

Q14: The table below contains hypothetical international balance

Q15: What is the official settlement account and

Q17: Explain how China used the inflationary peg

Q18: The table below contains hypothetical international balance

Q19: Answer the next five questions on the

Q20: In the table below are the supply

Q21: List and explain the major determinants of