Essay

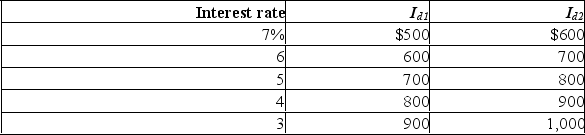

The table below gives data on interest rates and investment demand in a hypothetical economy.Figures are in billions.  (a) Use the Id1 schedule.Assume that the government needs to finance a budget deficit and this public borrowing increases the interest rate from 5% to 6%.How much crowding-out of private investment will occur?

(a) Use the Id1 schedule.Assume that the government needs to finance a budget deficit and this public borrowing increases the interest rate from 5% to 6%.How much crowding-out of private investment will occur?

(b) Now assume that the deficit is used to improve the performance of the economy, and that as a consequence the investment-demand schedule changes from Id1 to Id2.At the same time, the interest rate rises from 5% to 6% as the government borrows money to finance the deficit.How much crowding-out of private investment will occur in this case?

(c) Graph the two investment-demand schedules on the graph below and show the difference between the two events.Put the interest rate on the vertical axis and the quantity of investment demanded on the horizontal axis.

Correct Answer:

Verified

(a) $100 billion ($700 - $600).

(b) Ther...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(b) Ther...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: In Year 1, the full-employment budget showed

Q28: Which fiscal policy, government spending or taxes,

Q29: Give two examples of expansionary fiscal policy.What

Q30: What is the difference between the actual

Q31: Describe what occurred during the European Sovereign

Q33: What information would be important for assessing

Q34: Can a large public debt cause a

Q35: During which phases of the business cycle

Q36: In Year 1, the full-employment budget showed

Q37: Why do some economists, who favour government