Multiple Choice

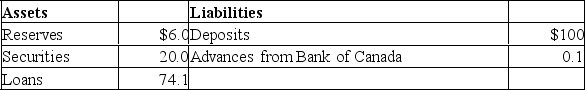

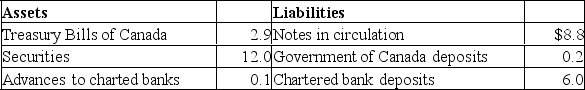

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada.Do not cumulate your answers; that is, do return to the data given in the original balance sheets in answering each question.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information.Suppose the Bank of Canada buys $2 in securities from the public.As a result of this transaction, the supply of money will:

Refer to the above information.Suppose the Bank of Canada buys $2 in securities from the public.As a result of this transaction, the supply of money will:

A) directly increase by $2 and the money-creating potential of the chartered banking system will increase by $38.

B) directly increase by $40 and the money-creating potential of the chartered banking system will increase by $800.

C) directly increase by $2 and the money-creating potential of the chartered banking system will be unaffected.

D) be unaffected but the money-creating potential of the chartered banking system will increase by $40.

Correct Answer:

Verified

Correct Answer:

Verified

Q71: Assume the desired reserve ratio is 25

Q76: If the demand for money and the

Q85: Which of the following is an expansionary

Q98: Assume the equation for the total demand

Q122: To increase the overnight lending rate, the

Q175: In comparison with fiscal policy, monetary policy

Q204: An expansionary monetary policy may be less

Q211: Quantitative easing refers to:<br>A)the selling of bonds

Q300: Other things equal, an expansionary monetary policy

Q314: A bond with no expiration has an