Multiple Choice

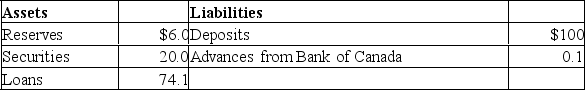

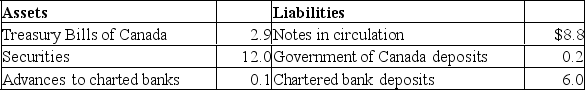

The following is a simplified consolidated balance sheet for the chartered banking system and the Bank of Canada.Assume a desired reserve ratio of 5 percent for the chartered banks.All figures are in billions of dollars.CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM  BALANCE SHEET: BANK OF CANADA

BALANCE SHEET: BANK OF CANADA Refer to the above information, suppose the Bank of Canada sells $2 in securities directly to the chartered banks.As a result of this transaction, the supply of money:

Refer to the above information, suppose the Bank of Canada sells $2 in securities directly to the chartered banks.As a result of this transaction, the supply of money:

A) will directly increase by $2 and the money-creating potential of the chartered banking system will increase by $38.

B) will directly decrease by $2 and the money-creating potential of the chartered banking system will decrease by $40.

C) is not directly affected, but the money-creating potential of the chartered banking system will decrease by $40.

D) will decrease by $2, but the money-creating potential of the chartered banking system will not be affected.

Correct Answer:

Verified

Correct Answer:

Verified

Q83: Which of the following will not happen

Q114: In the consolidated balance sheet of the

Q117: The Bank of Canada:<br>A)acts as a fiscal

Q132: Most economists feel that changes in the

Q161: A restrictive monetary policy invoked to reduce

Q169: In the cause-effect chain, a restrictive monetary

Q196: A headline reads: " Bank of Canada

Q230: An important routine function of the Bank

Q234: Monetary policy is:<br>A)faster than fiscal policy.<br>B)slower than

Q235: The interest rate at which the Bank