Multiple Choice

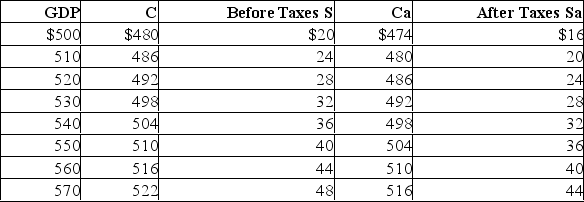

Refer to the above table.If an additional lump-sum tax of $20 were imposed, we would expect:

Refer to the above table.If an additional lump-sum tax of $20 were imposed, we would expect:

A) equilibrium GDP to fall by $30.

B) equilibrium GDP to fall by $20.

C) equilibrium GDP to fall by $50.

D) equilibrium GDP to rise by $24.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: In the aggregate expenditures model, it is

Q47: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q48: For a private closed economy aggregate expenditures

Q48: The table shows a private, open economy.All

Q54: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q55: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q112: If a lump-sum tax of $40 billion

Q125: If at some level of GDP the

Q140: The equilibrium level of GDP in a

Q205: In an aggregate expenditures diagram equal increases