Multiple Choice

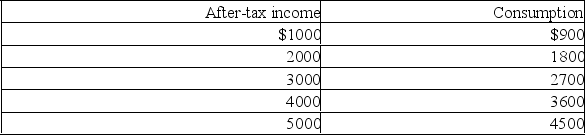

The above data suggest that:

The above data suggest that:

A) a policy of tax reduction will increase consumption.

B) a policy of tax increases will increase consumption.

C) tax changes will have no impact on consumption.

D) after-tax income should be lowered to increase consumption.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: If an economy is operating inside its

Q109: The concept of opportunity cost<br>A) is irrelevant

Q142: The production possibilities curve shows various combinations

Q153: In a linear equation relating income and

Q182: The production possibilities curve represents:<br>A)the maximum amount

Q207: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q209: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q212: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q255: A point inside the production possibilities curve

Q338: The basic purpose of the other-things-equal assumption