Essay

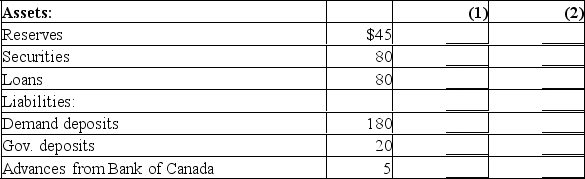

The following are simplified balance sheets for the chartered banking system and the Bank of Canada.Perform the two following transactions, (1) and (2), making appropriate changes in columns (1) and (2) in each balance sheet.Do not cumulate your answers.Also, answer these three questions for each part: (a) What change, if any, took place in the money supply as a direct result of this transaction? (b) What change, if any, occurred in chartered bank reserves? (c) What change occurred in the money-creating potential of the chartered banking system if the reserve ratio is 20%? All figures are in billions of dollars.Consolidated Balance Sheet: Chartered Banking System

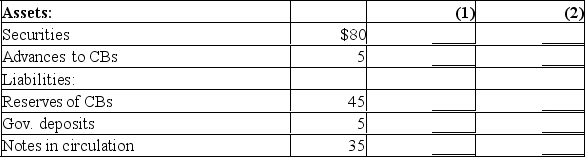

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

Correct Answer:

Verified

(1) (a) There is no direct change in the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Differentiate between expansionary and restrictive monetary policies.

Q15: Why is the transactions demand for money

Q17: Explain how nominal GDP and the real

Q32: Explain how the net export effect strengthens

Q38: Suppose the economy is experiencing a recession

Q38: Use the table below to answer the

Q41: Identify two key tools of monetary policy.

Q44: The following are simplified balance sheets for

Q45: How does monetary policy affect equilibrium GDP?

Q142: What are the two reasons that people