Essay

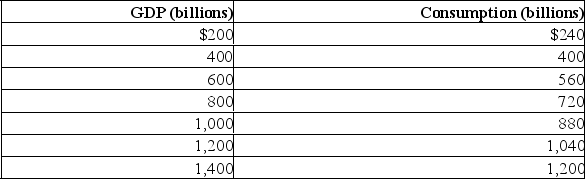

Assume that without any taxes the consumption schedule for an economy is as shown in the table.Also assume that investment, net exports, and government expenditures do not change with changes in real GDP.  (a) What are the MPC, MPS, and the size of the multiplier?

(a) What are the MPC, MPS, and the size of the multiplier?

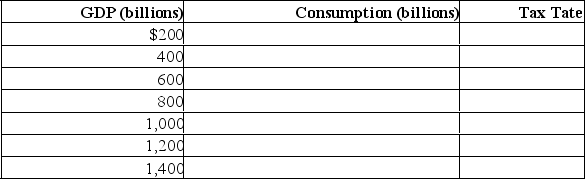

(b) Assume a lump-sum tax of $10 billion is imposed at all levels of GDP.Determine consumption and the tax rate at each level of GDP by completing the following table.Is tax regressive, proportional, or progressive? Compare the multiplier under the lump-sum tax with the pre-tax multiplier.  (c) Assume instead that a proportional tax of 10% is imposed at all levels of GDP.Determine consumption at each level of GDP by completing the following table.Compare the multiplier under the proportional tax with the multiplier under the lump-sum tax.Explain why a proportional or progressive tax system contributes to greater economic stability as compared with the lump-sum tax.

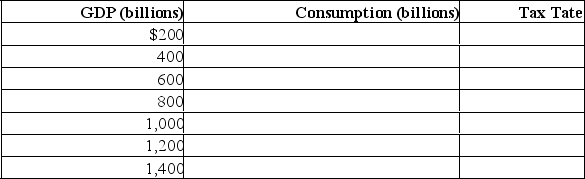

(c) Assume instead that a proportional tax of 10% is imposed at all levels of GDP.Determine consumption at each level of GDP by completing the following table.Compare the multiplier under the proportional tax with the multiplier under the lump-sum tax.Explain why a proportional or progressive tax system contributes to greater economic stability as compared with the lump-sum tax.

Correct Answer:

Verified

(a) The MPC is .8.(160/200).The MPS is ....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: If the government is not implementing a

Q13: In 2011, the public debt was $617

Q16: Adam Smith once wrote: "What is prudence

Q17: State three causes of the public debt.

Q22: Evaluate: A tax system in which those

Q35: During which phases of the business cycle

Q35: The following table shows government spending and

Q40: Under a particular tax system, the government

Q52: Describe the impact of the European Sovereign

Q163: Explain the crowding-out effect.