Essay

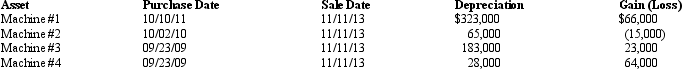

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Spencer has an investment in two parcels

Q3: Stella purchased vacant land in 2006 that

Q6: A business machine purchased April 10,2012,for $62,000

Q11: Larry was the holder of a patent

Q16: If a capital asset is sold at

Q32: A franchisor licenses its mode of business

Q54: A security that was purchased by an

Q55: Lynne owns depreciable residential rental real estate

Q63: Hiram is a computer engineer and, while

Q143: When a patent is transferred, the most