Essay

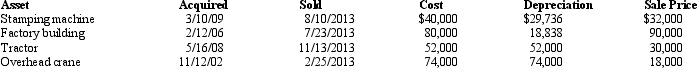

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Correct Answer:

Verified

The stamping machine ($21,736),tractor (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: The tax law requires that capital gains

Q26: A lease cancellation payment received by a

Q59: Why is it generally better to have

Q89: Recognized gains and losses from disposition of

Q97: In 2013,Mark has $18,000 short-term capital loss,$7,000

Q103: In 2013,an individual taxpayer has $863,000 of

Q104: Harold is a head of household,has

Q105: Vertigo,Inc.,has a 2013 net § 1231 loss

Q106: Verway,Inc.,has a 2013 net § 1231 gain

Q125: A barn held more than one year