Multiple Choice

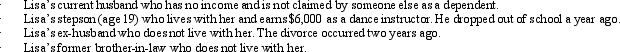

During 2013,Lisa (age 66) furnished more than 50% of the support of the following persons:  Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Lisa claim?

Presuming all other dependency tests are met,on a separate return how many personal and dependency exemptions may Lisa claim?

A) Two.

B) Three.

C) Four.

D) Five.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Which of the following statements is true

Q43: If a lottery prize winner transfers the

Q48: The kiddie tax does not apply to

Q83: A scholarship recipient at State University may

Q110: Under the Federal income tax formula for

Q123: In 2013,Cindy had the following transactions: <img

Q127: In 2012,Juan and Juanita incur $9,800 in

Q128: Once a child reaches age 19, the

Q134: Which, if any, of the following statements

Q176: Kim, a resident of Oregon, supports his