Multiple Choice

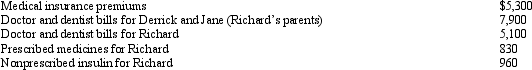

Richard,age 50,is employed as an actuary.For calendar year 2013,he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2013 and received the reimbursement in January 2014.What is Richard's maximum allowable medical expense deduction for 2013?

Derrick and Jane would qualify as Richard's dependents except that they file a joint return.Richard's medical insurance policy does not cover them.Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2013 and received the reimbursement in January 2014.What is Richard's maximum allowable medical expense deduction for 2013?

A) $0.

B) $7,090.

C) $13,000.

D) $20,090.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Claude's deductions from AGI exceed the standard

Q2: Bradley has two college-age children,Clint,a freshman at

Q8: Arnold is married to Sybil,who abandoned him

Q9: Fred and Lucy are married,ages 33 and

Q10: Merle is a widow,age 80 and blind,who

Q23: A taxpayer may qualify for the credit

Q35: An increase in a taxpayer's AGI could

Q43: Under the terms of a divorce agreement,

Q52: Stealth taxes are directed at lower income

Q58: If a scholarship does not satisfy the