Multiple Choice

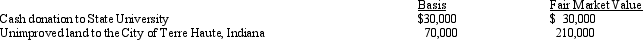

Karen,a calendar year taxpayer,made the following donations to qualified charitable organizations in 2013:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

A) $84,000 if the reduced deduction election is not made.

B) $100,000 if the reduced deduction election is not made.

C) $165,000 if the reduced deduction election is not made.

D) $170,000 if the reduced deduction election is made.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Expenses that are reimbursed by a taxpayer's

Q10: In which, if any, of the following

Q22: Which of the following statements concerning the

Q29: For purposes of computing the deduction for

Q33: A qualifying child cannot include:<br>A)A nonresident alien.<br>B)A

Q42: Nelda is married to Chad,who abandoned her

Q45: The Dargers have itemized deductions that exceed

Q45: Under the terms of a divorce agreement,

Q46: Evan and Eileen Carter are husband and

Q114: George and Erin are divorced, and George