Multiple Choice

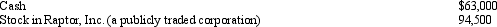

During 2013,Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2013 is $189,000.What is Ralph's charitable contribution deduction for 2013?

Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2013 is $189,000.What is Ralph's charitable contribution deduction for 2013?

A) $56,700.

B) $63,000.

C) $94,500.

D) $157,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Lee, a citizen of Korea, is a

Q25: Sarah furnishes more than 50% of the

Q58: Employee business expenses for travel qualify as

Q66: For purposes of computing the credit for

Q79: Jermaine and Kesha are married,file a joint

Q80: During 2013,Marvin had the following transactions: <img

Q81: In 2013,Ed is 66 and single.If he

Q84: Darren,age 20 and not disabled,earns $4,000 during

Q92: Monique is a resident of the U.S.

Q133: Ellen, age 12, lives in the same