Multiple Choice

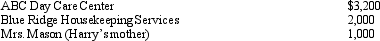

Harry and Wilma are married and file a joint income tax return.On their tax return,they report $44,000 of adjusted gross income ($20,000 salary earned by Harry and $24,000 salary earned by Wilma) and claim two exemptions for their dependent children.During the year,they pay the following amounts to care for their 16-year old son and 6-year old daughter while they work.  Harry and Wilma may claim a credit for child and dependent care expenses of:

Harry and Wilma may claim a credit for child and dependent care expenses of:

A) $840.

B) $1,040.

C) $1,200.

D) $1,240.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The basic and additional standard deductions both

Q33: Sylvia,age 17,is claimed by her parents as

Q35: In December 2013,Emily,a cash basis taxpayer,received a

Q47: Workers' compensation benefits are included in gross

Q59: Jacob and Emily were co-owners of a

Q59: During the current year, Doris received a

Q79: In meeting the criteria of a qualifying

Q88: Agnes receives a $5,000 scholarship which covers

Q109: For tax purposes, married persons filing separate

Q122: Adjusted gross income (AGI) sets the ceiling