Essay

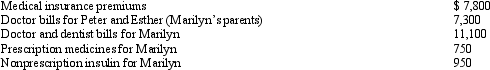

Marilyn,age 38,is employed as an architect.For calendar year 2013,she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2013 and received the reimbursement in January 2014.What is Marilyn's maximum allowable medical expense deduction for 2013?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2013 and received the reimbursement in January 2014.What is Marilyn's maximum allowable medical expense deduction for 2013?

Correct Answer:

Verified

Marilyn's medical expense deduction is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: A decrease in a taxpayer's AGI could

Q17: Under the income tax formula, a taxpayer

Q17: Under the terms of a divorce agreement,

Q21: Assuming a taxpayer qualifies for the exclusion

Q36: Kevin and Sue have two children, ages

Q98: Paula transfers stock to her former spouse,

Q158: Brad,who uses the cash method of accounting,lives

Q161: Buddy and Hazel are ages 72 and

Q164: In April 2013,Bertie,a calendar year cash basis

Q167: Ellen,age 39 and single,furnishes more than 50%