Multiple Choice

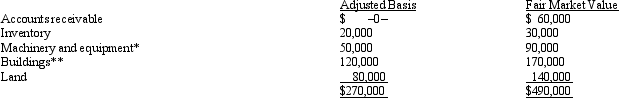

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Molly transfers land with an adjusted basis

Q22: Bev and Cabel each have 50% ownership

Q29: C corporations and their shareholders are subject

Q71: Candace, who is in the 33% tax

Q77: Ralph wants to purchase either the stock

Q98: Malcomb and Sandra (shareholders) each loan Crow

Q118: If the IRS reclassifies debt as equity

Q120: Mercedes owns a 30% interest in Magenta

Q129: An effective way for all C corporations

Q165: Robin Company has $100,000 of income before