Essay

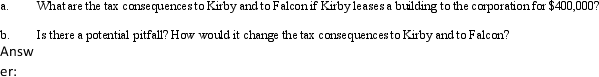

Kirby,the sole shareholder of Falcon,Inc.,leases a building to the corporation.The taxable income of the corporation for 2013,before deducting the lease payments,is projected to be $500,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: A benefit of an S corporation when

Q1: Beige, Inc., has 3,000 shares of stock

Q4: Alice contributes equipment (fair market value of

Q6: Bart contributes $100,000 to the Fish Partnership

Q9: Kirk is establishing a business in 2013

Q41: The legal form of Edith and Fran's

Q86: In the purchase of a partnership, does

Q100: Cory is going to purchase the assets

Q111: Which of the following is correct regarding

Q114: Roger owns 40% of the stock of