Essay

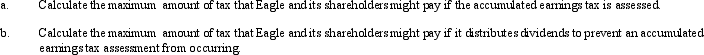

Eagle,Inc.recognizes that it may have an accumulated earnings tax problem.According to its calculation,Eagle anticipates it has accumulated taxable income,before reduction for dividends paid,of $400,000 in 2013.Assume that its shareholders are in the 33% marginal tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Q50: The corporation has a greater potential for

Q52: For Federal income tax purposes, a business

Q61: Arthur is the sole shareholder of Purple,

Q81: Wally contributes land (adjusted basis of $30,000;

Q87: The ACE adjustment associated with the C

Q89: Alice and Joe are going to form

Q99: Which of the following statements is incorrect?<br>A)

Q107: C corporations and S corporations can generate

Q126: Khalid contributes land (fair market value of

Q130: The accumulated earnings tax rate in 2013