Essay

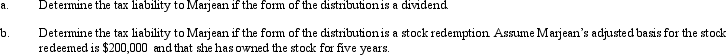

Swallow,Inc.,is going to make a distribution of $700,000 to Marjean who is in the 35% tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q50: The corporation has a greater potential for

Q78: If a business entity has a majority

Q82: A corporation can avoid the accumulated earnings

Q83: Of the corporate types of entities, all

Q87: The ACE adjustment associated with the C

Q94: Alanna contributes property with an adjusted basis

Q99: Which of the following statements is incorrect?<br>A)

Q116: Techniques are available that may permit a

Q126: Khalid contributes land (fair market value of

Q130: The accumulated earnings tax rate in 2013