Essay

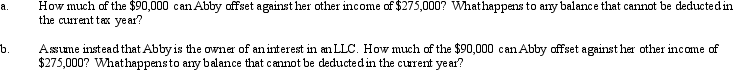

Abby is a limited partner in a limited partnership.Her basis in the partnership interest is $80,000 with an at-risk basis of $75,000.Abby's share of the partnership loss for the tax year is $90,000.She has other income of $275,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Arnold purchases a building for $750,000 which

Q11: An S corporation election for Federal income

Q65: List some techniques which can be used

Q70: For a limited liability company with 100

Q77: Which of the following are "reasonable needs"

Q85: If an individual contributes an appreciated personal

Q112: Under what circumstances, if any, do the

Q114: Included among the factors that influence the

Q117: Making distributions to shareholders that are deductible

Q134: Trolette contributes property with an adjusted basis