Essay

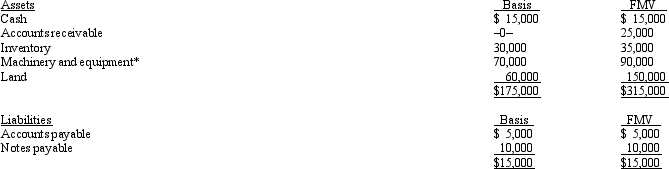

Ralph owns all the stock of Silver,Inc.,a C corporation for which his adjusted basis is $225,000.Ralph founded Silver 12 years ago.The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Ralph has agreed to sell the business to Marilyn and they have agreed on a purchase price of $350,000 less any outstanding liabilities.They are both in the 35% tax bracket,and Silver is in the 34% tax bracket.

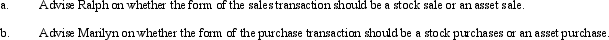

Correct Answer:

Verified

Correct Answer:

Verified

Q15: The profits of a business owned by

Q29: Dudley has a 20% ownership interest in

Q33: To which of the following entities does

Q36: Meg has an adjusted basis of $150,000

Q39: John wants to buy a business whose

Q43: Amos contributes land with an adjusted basis

Q45: A corporation may alternate between S corporation

Q45: For a C corporation to be classified

Q49: A sole proprietorship files Schedule C of

Q127: In the sale of a partnership, does