Essay

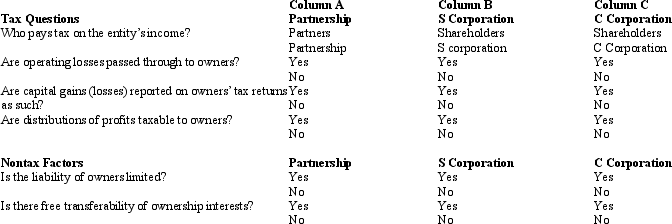

Compare the basic tax and nontax factors of doing business as a partnership,an S corporation,and a C corporation.Circle the correct answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The correc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q23: Quail Corporation is a C corporation with

Q29: Bjorn owns a 60% interest in an

Q62: Carol and Candace are equal partners in

Q75: A characteristic of FUTA is that:<br>A)It is

Q81: The Federal gas-guzzler tax applies only to

Q93: During the current year,Maroon Company had $125,000

Q107: Which, if any, of the following transactions

Q111: The tax law contains various tax credits,

Q117: Both economic and social considerations can be

Q161: When Congress enacts a tax cut that