Multiple Choice

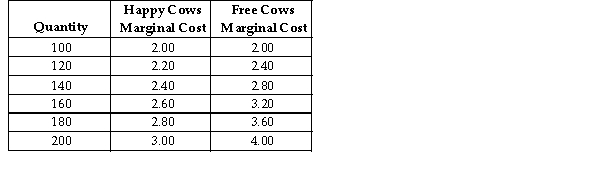

Happy Cows and Free Cows are two separate perfectly competitive dairy farms. The table above shows the respective firms' marginal cost at various production levels.

Happy Cows and Free Cows are two separate perfectly competitive dairy farms. The table above shows the respective firms' marginal cost at various production levels.

-Refer to the table above. Suppose the perfectly competitive market for dairy products had a 40 percent chance of a high price of $3.00 and a 60 percent chance of a low price of $2.00. However, both Happy Cows and Free Cows have revised their probabilities and now believe that the probability of a high price of $3.00 is 80 percent and the probability of a low price of $2.00 is 20 percent. If the managers of Free Cows want to maximize expected profit based on the new probabilities by how much will they change the quantity produced?

A) Free Cows will decrease their production by 40 units

B) Free Cows will increase their production by 20 units.

C) Free Cows will increase their production by 40 units.

D) Free Cows will decrease their production by 20 units.

Correct Answer:

Verified

Correct Answer:

Verified

Q104: In an independent private values sealed- bid

Q105: As a manager holding an auction with

Q106: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1687/.jpg" alt=" Happy Cows and

Q107: Happy Cows is bidding on a large

Q108: A manager is participating in an auction

Q110: An expected value is the_average of _outcomes.<br>A)unweighted;

Q111: If a firm maximizes its expected profit,

Q112: Firms can protect information in the form

Q113: A restaurant owner hires a waiter to

Q114: All of the following are considered trade