Multiple Choice

Exhibit 9.1

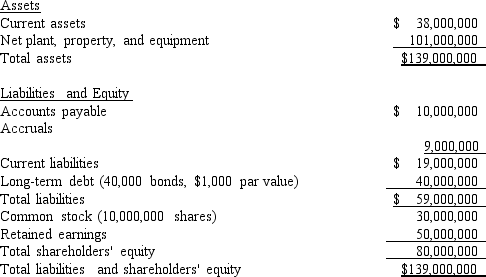

The Collins Group, a leading producer of custom automobile accessories, has hired you to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 9.1.What is the best estimate of the firm's WACC?

A) 10.85%

B) 11.19%

C) 11.53%

D) 11.88%

E) 12.24%

Correct Answer:

Verified

Correct Answer:

Verified

Q4: In general, firms should use their weighted

Q8: Suppose Acme Industries correctly estimates its WACC

Q17: Assume that you are an intern with

Q38: Granby Foods' (GF)balance sheet shows a total

Q43: The cost of common equity obtained by

Q46: The Anderson Company has equal amounts of

Q57: The cost of debt,r<sub>d</sub>,is normally less than

Q63: If the expected dividend growth rate is

Q64: Exhibit 9.1<br>The Collins Group, a leading producer

Q71: Adams Inc.has the following data: r<sub>RF</sub> =