Short Answer

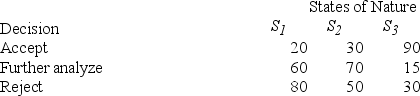

The quality control manager for NKA Inc. must decide whether to accept (alternative 1), further analyze (alternative 2), or reject (alternative 3) an incoming shipment (lot) of microchips. The historical data indicate that there is a 30 percent chance that the lot is poor quality (S1), 50 percent chance that the lot is fair quality (S2), and 20 percent chance that the lot is good quality (S3). Assume the following payoff table is available. The values in the payoff table are in thousands of dollars.

What is the maximum amount that the quality control manager would be willing to pay for perfect information?

What is the maximum amount that the quality control manager would be willing to pay for perfect information?

Correct Answer:

Verified

EVPI = 21

Expected payoff under certaint...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Expected payoff under certaint...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: The expected value criterion is used for

Q8: The _ criterion for choosing among alternative

Q9: Alternatives 1 and 2 in the following

Q10: The expected _ of a decision maker

Q11: An investor is looking at three possible

Q13: An automobile insurance company is in the

Q14: Alternatives 1 and 2 in the following

Q15: When we assess the worth of sample

Q16: Alternatives 1 and 2 in the following

Q17: Maximin is a criterion used when making