Multiple Choice

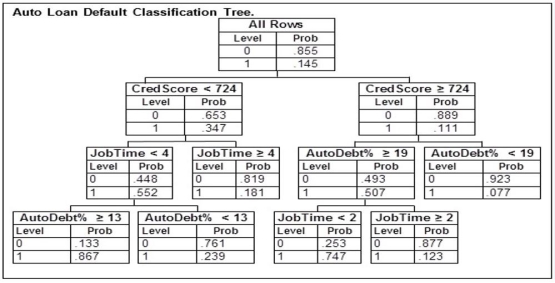

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower with a credit score of 668 who has just started their current job is applying for a loan with payments equaling 7% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be ________.

A potential borrower with a credit score of 668 who has just started their current job is applying for a loan with payments equaling 7% of their income. Based on this classification tree, the best estimate of the probability that this loan applicant would default would be ________.

A) .000

B) .181

C) .239

D) .867

E) 1.000

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Because different classification techniques will perform better

Q55: An MBA admissions officer wishes to predict

Q56: A cable television company has randomly selected

Q57: An automobile finance company analyzed a sample

Q58: Suppose that a bank wishes to predict

Q60: Which of the following possible response variables

Q61: An automobile finance company analyzed a sample

Q62: An automobile finance company analyzed a sample

Q63: An internet service provider (ISP) has randomly

Q64: An MBA admissions officer wishes to predict