Multiple Choice

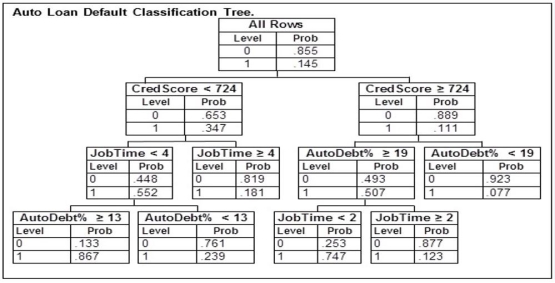

An automobile finance company analyzed a sample of recent automobile loans to try to determine key factors in identifying borrowers who would be likely to default on their auto loan. The response variable Default equals 1 if the borrower defaulted during the term of the loan and 0 otherwise. The predictor variable AutoDebt% was the ratio (expressed as a percent) of the required loan payments to the borrower's take-home income at the time of purchase. JobTime was the number of years the borrower had worked at their current job at the time of purchase. CredScore was the borrower's credit score at the time of purchase. Below is part of the classification tree the finance company derived from the data collected in the study. Assume they classify those with a default probability estimate of at least .5 as Defaulters.  A potential borrower who has just started their current job would like to apply for a loan with payments equaling 17% of their income. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following credit scores, which is the lowest this potential borrower could have to be approved for the loan?

A potential borrower who has just started their current job would like to apply for a loan with payments equaling 17% of their income. To be approved for the loan they would need to be classified as a non-Defaulter. Of the following credit scores, which is the lowest this potential borrower could have to be approved for the loan?

A) 421

B) 724

C) 795

D) There is no credit score which would allow them to be classified as a non-Defaulter.

E) There is insufficient information to determine the minimum allowable credit score.

Correct Answer:

Verified

Correct Answer:

Verified

Q67: Because different trust levels may be appropriate

Q68: Suppose that a bank wishes to predict

Q69: A cable television company has randomly selected

Q70: An internet service provider (ISP) has randomly

Q71: An automobile finance company analyzed a sample

Q73: An internet service provider (ISP) has randomly

Q74: Which of the following possible response variables

Q75: The confusion matrix for a classification tree

Q76: An internet service provider (ISP) has randomly

Q77: Combining the estimates or predictions obtained from