Multiple Choice

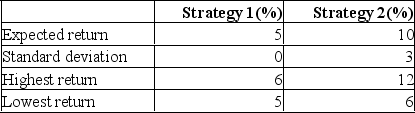

Consider these two investment strategies:  Strategy __________ is the dominant strategy because __________.

Strategy __________ is the dominant strategy because __________.

A) 1; it is riskless

B) 1; it has the highest reward/risk ratio

C) 2; its return is greater than or equal to the return of Strategy 1

D) 2; it has the highest reward/risk ratio

Correct Answer:

Verified

Correct Answer:

Verified

Q3: To determine the optimal risky portfolio in

Q3: Consider the Treynor-Black model.The alpha of an

Q4: The Black-Litterman model and Treynor-Black model are<br>A)nice

Q6: A purely passive strategy<br>A)uses only index funds.<br>B)uses

Q8: Active portfolio management consists of<br>A)market timing.<br>B)security analysis.<br>C)indexing.<br>D)market

Q9: Passive portfolio management consists of<br>A)market timing.<br>B)security analysis.<br>C)indexing.<br>D)market

Q11: A manager who uses the mean-variance theory

Q17: The Treynor-Black model requires estimates of<br>A) alpha/beta.<br>B)

Q30: Consider the Treynor-Black model. The alpha of

Q32: Benchmark risk<br>A) is inevitable and is never