Multiple Choice

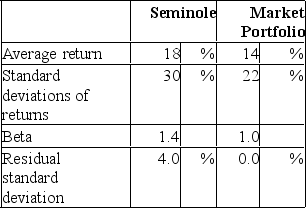

The following data are available relating to the performance of Seminole Fund and the market portfolio:  The risk-free return during the sample period was 6%.

The risk-free return during the sample period was 6%.

If you wanted to evaluate the Seminole Fund using theM2measure, what percent of the adjusted portfolio would need to be invested in T-Bills?

A) -36% (borrow)

B) 50%

C) 8%

D) 36%

E) 27%

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Suppose you purchase 100 shares of GM

Q14: Most professionally managed equity funds generally<br>A)outperform the

Q15: The comparison universe is<br>A)a concept found only

Q16: Suppose you own two stocks, A and

Q17: The following data are available relating to

Q20: In a particular year, Razorback Mutual Fund

Q21: In measuring the comparative performance of different

Q22: In a particular year, Razorback Mutual Fund

Q27: Suppose you purchase one share of the

Q65: Suppose the risk-free return is 6%. The