Multiple Choice

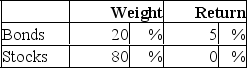

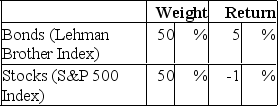

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:  The return on a bogey portfolio was 2%, calculated from the following information.

The return on a bogey portfolio was 2%, calculated from the following information. The contribution of asset allocation across markets to the Razorback Fund's total excess return was

The contribution of asset allocation across markets to the Razorback Fund's total excess return was

A) -1.80%.

B) -1.00%.

C) 0.80%.

D) 1.00%.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: The Value Line Index is an equally-weighted

Q25: The following data are available relating to

Q26: The M<sup>2</sup> measure was developed by<br>A)Merton and

Q27: Henriksson (1984) found that, on average, betas

Q28: The Sharpe, Treynor, and Jensen portfolio performance

Q30: In a particular year, Aggie Mutual Fund

Q31: Suppose you own two stocks, A and

Q32: The _ measures the reward to volatility

Q33: The Modigliani M<sup>2</sup> measure and the Treynor

Q34: The following data are available relating to