Multiple Choice

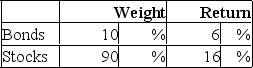

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:  The return on a bogey portfolio was 10%, calculated as follows:

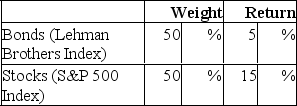

The return on a bogey portfolio was 10%, calculated as follows: The total excess return on the Aggie managed portfolio was

The total excess return on the Aggie managed portfolio was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The Jensen portfolio evaluation measure<br>A)is a measure

Q5: Morningstar's RAR method I) is one of

Q6: The following data are available relating to

Q8: A portfolio manager's ranking within a comparison

Q9: Studies of style analysis have found that

Q10: The following data are available relating to

Q12: Suppose two portfolios have the same average

Q16: Suppose you purchase one share of the

Q43: The comparison universe is not<br>A) a concept

Q44: _ developed a popular method for risk-adjusted