Multiple Choice

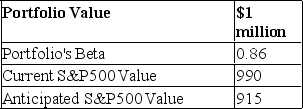

You are given the following information about a portfolio you are to manage.For the long term, you are bullish, but you think the market may fall over the next month.  How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

How many contracts should you buy or sell to hedge your position? Allow fractions of contracts in your answer.

A) Sell 3.477

B) Buy 3.477

C) Sell 4.236

D) Buy 4.236

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Suppose that the risk-free rates in the

Q25: A hedge ratio can be computed as<br>A)

Q37: If a stock index futures contract is

Q38: Which two indices had the highest correlation

Q40: If interest rate parity holds,<br>A)covered interest arbitrage

Q42: You are given the following information about

Q43: Suppose that the risk-free rates in the

Q44: Commodity futures pricing<br>A)must be related to spot

Q45: If covered interest arbitrage opportunities do not

Q46: You are given the following information about