Multiple Choice

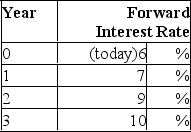

Suppose that all investors expect that interest rates for the 4 years will be as follows:  If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000)

If you have just purchased a 4-year zero-coupon bond, what would be the expected rate of return on your investment in the first year if the implied forward rates stay the same? (Par value of the bond = $1,000)

A) 5%

B) 7%

C) 9%

D) 10%

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Which of the following are possible explanations

Q37: If the value of a Treasury bond

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What should the

Q42: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What should the

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7045/.jpg" alt=" What is the

Q44: The following is a list of prices

Q46: The "break-even" interest rate for year n

Q47: Suppose that all investors expect that interest

Q48: The most recently issued Treasury securities are

Q50: According to the expectations hypothesis, an upward-sloping