Multiple Choice

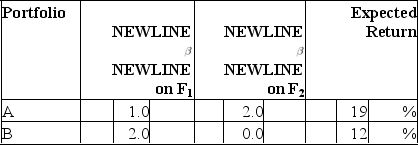

Consider the multifactor APT.There are two independent economic factors, F1andF2.The risk-free rate of return is 6%.The following information is available about two well-diversified portfolios:  Assuming no arbitrage opportunities exist, the risk premium on the factorF1portfolio should be

Assuming no arbitrage opportunities exist, the risk premium on the factorF1portfolio should be

A) 3%.

B) 4%.

C) 5%.

D) 6%.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A professional who searches for mispriced securities

Q23: Consider the one-factor APT. The standard deviation

Q28: In a multifactor APT model, the coefficients

Q39: Consider the multifactor APT with two factors.

Q45: Consider a single factor APT.Portfolio A has

Q46: The no-arbitrage equation of the APT states

Q54: Black argues that past risk premiums on

Q56: Consider the one-factor APT. The variance of

Q61: Consider the multifactor model APT with three

Q75: The APT differs from the CAPM because