Multiple Choice

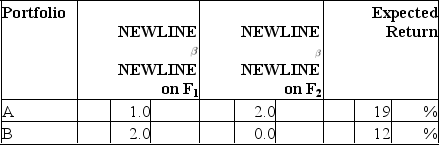

Consider the multifactor APT.There are two independent economic factors, F1andF2.The risk-free rate of return is 6%.The following information is available about two well-diversified portfolios:  Assuming no arbitrage opportunities exist, the risk premium on the factorF2portfolio should be

Assuming no arbitrage opportunities exist, the risk premium on the factorF2portfolio should be

A) 3%.

B) 4%.

C) 5%.

D) 6%.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In a multifactor APT model, the coefficients

Q4: Consider the one-factor APT. The standard deviation

Q14: Consider the one-factor APT. The variance of

Q27: In the APT model, what is

Q28: Which of the following is(are) true regarding

Q32: Advantage(s) of the APT is(are)<br>A)that the model

Q34: Which of the following is true about

Q35: To take advantage of an arbitrage opportunity,

Q42: A well-diversified portfolio is defined as<br>A) one

Q52: Consider the single factor APT. Portfolio A