Multiple Choice

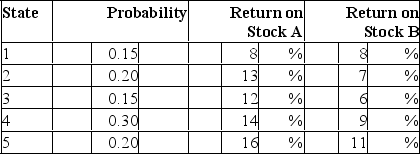

Consider the following probability distribution for stocks A and B:  The standard deviations of stocks A and B are _____ and _____, respectively.

The standard deviations of stocks A and B are _____ and _____, respectively.

A) 1.56%; 1.99%

B) 2.45%; 1.66%

C) 3.22%; 2.01%

D) 1.54%; 1.11%

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Given an optimal risky portfolio with expected

Q31: Security X has expected return of 14%

Q35: Consider two perfectly negatively correlated risky securities,

Q36: Consider the following probability distribution for stocks

Q37: Consider the following probability distribution for stocks

Q38: Consider two perfectly negatively correlated risky securities,

Q39: Firm-specific risk is also referred to as<br>A)

Q39: Which of the following is not a

Q44: The capital allocation line provided by a

Q55: Portfolio theory as described by Markowitz is