Multiple Choice

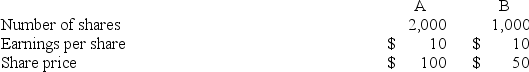

Companies A and B are valued as follows:

Company A now acquires B by offering one (new) share of A for every two shares of B (that is, after the merger, there are 2,500 shares of A outstanding) . If investors are aware that there are no economic gains from the merger, what is the price-earnings ratio of A's stock after the merger?

A) 7.5

B) 8.3

C) 10

D) 5

Correct Answer:

Verified

Correct Answer:

Verified

Q40: A vertical merger is one in which

Q41: The following are sensible motives for mergers:<br>I.prevent

Q42: Given the following data,<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7066/.jpg" alt="Given the

Q43: Which of the following is not an

Q44: Briefly discuss takeover defenses.

Q46: Antitrust law can be enforced by the

Q47: Briefly explain what is meant by the

Q48: If an acquisition is completed using a

Q49: The main difference to shareholders between a

Q50: A conglomerate merger is one in which