Multiple Choice

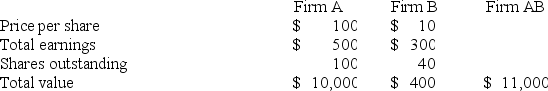

The following data on a merger are given:

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. Calculate the NPV of the merger.

A) $200

B) $400

C) $600

D) $150

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Diversification is a very sensible reason for

Q20: Who are antitakeover defenses designed to protect?

Q21: Following an acquisition, the acquiring firm's balance

Q22: Compensation paid to top management who lose

Q23: A would-be acquirer making a tender offer

Q25: If Firm A acquires Firm B and

Q26: Assume the following data:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7066/.jpg" alt="Assume the

Q27: Takeover defenses appear to favor<br>A)stockholders.<br>B)workers.<br>C)creditors.<br>D)managers.<br>

Q28: Which of the following actions by an

Q29: Firm A plans to acquire Firm B