Multiple Choice

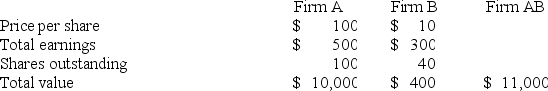

The following data on a merger are given:

Firm A has proposed to acquire Firm B at a price of $20 per share for Firm B's stock. What will earnings per share be for Firm A after the merger, assuming that cash is used in the acquisition?

A) $6

B) $7

C) $8

D) $5

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Who usually gains the most in a

Q55: The market for corporate control includes<br>I.mergers;<br>II.spin-offs and

Q56: In the purchase method of merger accounting,

Q57: AT&T and Time Warner is an example

Q58: Discuss the difficulties associated with a typical

Q60: Which of the following actions is least

Q61: It appears that target companies capture most

Q62: Examples of shark-repellent charter amendments include<br>A)supermajority.<br>B)waiting period.<br>C)supermajority

Q63: Explain the central tenet of the Clayton

Q64: Briefly discuss the different forms of acquisition.