Multiple Choice

Sun Corporation has had returns of -6 percent, 16 percent, 18 percent, and 28 percent for the past four years. Calculate the standard deviation of the returns using the correction for the loss of a degree of freedom shown below.

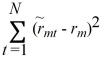

When variance is estimated from a sample of observed returns, we add the squared deviations and divide by N -1, where N is the number of observations. We divide by N -1 rather than N to correct for a loss of a degree of freedom. The formula is

Variance(

m ) =

Where

m is the market return in period t and rm is the mean of the values of rmt.

A) 11.6 percent

B) 14.3 percent

C) 13.4 percent

D) 14.0 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q59: The portfolio risk that cannot be eliminated

Q60: If the standard deviation of annual returns

Q61: The correlation coefficient between stock B and

Q62: If the correlation coefficient between the returns

Q63: What has been the approximate standard deviation

Q65: Diversification reduces the risk of a portfolio

Q66: How can individual investors diversify?

Q67: For the most part, stock returns tend

Q68: One dollar invested in a portfolio of

Q69: Assume the following data: Risk-free rate =