Multiple Choice

Use the following information to answer the question(s) below.

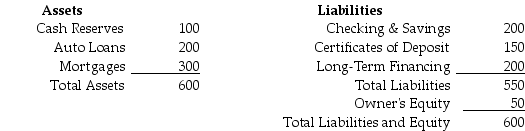

You are a risk manager for Security First Trust Savings and Loan (SFTSL) .SFTSL's balance sheet is as follows (in millions of dollars) :  The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

-If interest rates are currently 5%,but fall to 4%,your estimate of the approximate change in SFTSL equity is closest to:

A) 8% decrease.

B) 12% decrease.

C) 8% increase.

D) 14% increase.

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Use the information for the question(s)below.<br>Your firm

Q31: In December 2005,the spot exchange rate for

Q32: Which of the following statements regarding long-term

Q33: Use the following information to answer the

Q34: The cash-and-carry strategy consists of all of

Q36: Use the following information to answer the

Q37: In June 2016,the spot exchange rate for

Q38: Which of the following statements is FALSE?<br>A)Because

Q39: The risk that arises because the value

Q40: In December 2005,the spot exchange rate for