Essay

Use the information for the question(s)below.

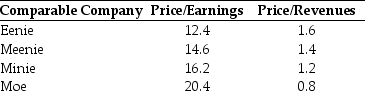

During the most recent fiscal year,KD Industries had revenues of $400 million and earnings of $30 million.KD has filed a registration statement with the SEC for its IPO.Before it is offered,KD's investment bankers would like to estimate the value of the company using comparable companies.The investment bankers have assembled the following information based on data for other companies in the same industry that have recently gone public.In each case,the ratios are based upon the IPO price.

-Based upon the price/revenue ratio,what would be a reasonable value for KD?

Correct Answer:

Verified

Taking the average ...

Taking the average ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Which of the following statements regarding firm

Q42: Use the following information to answer the

Q43: Which of the following statements is FALSE?<br>A)After

Q44: Luther Industries currently has 100 million shares

Q45: Which of the following statements is FALSE?<br>A)The

Q46: Use the following information to answer the

Q48: Use the following information to answer the

Q49: Which of the following statements is FALSE?<br>A)The

Q50: Use the following information to answer the

Q51: Use the following information to answer the