Essay

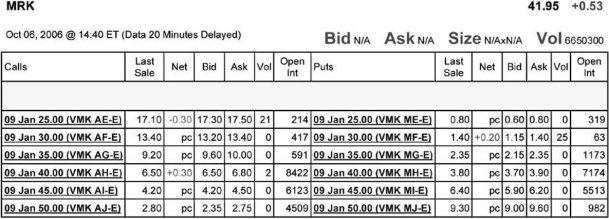

Use the table for the question(s)below.

Consider the following information on options from the CBOE for Merck:

-You have decided to buy ten January 2009 call options on Merck with an exercise price of $45 per share.How much will this transaction cost and are these contracts in or out of the money?

Correct Answer:

Verified

If you buy 10 call option contracts you ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Which of the following statements is FALSE?<br>A)Because

Q38: The payoff to the holder of a

Q39: Graph the payoff at expiration of a

Q40: Which of the following will NOT increase

Q41: Consider the following equation: C = S

Q43: An option strategy in which you hold

Q44: Use the table for the question(s)below.<br>Consider the

Q45: The market price of an option is

Q46: Rose Industries is currently trading for $47

Q47: The holder of a put option has:<br>A)the