Multiple Choice

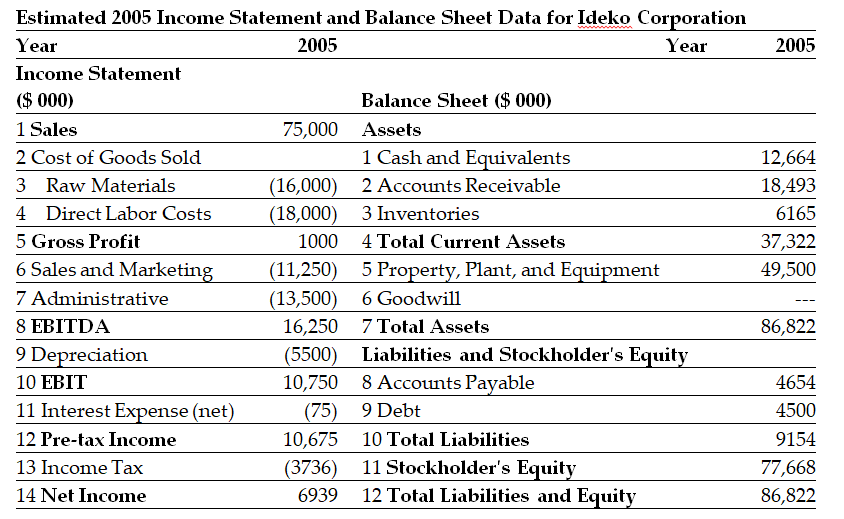

Use the tables for the question(s) below.

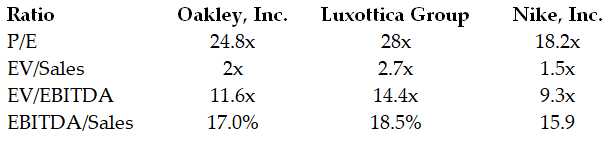

The following are financial ratios for three comparable companies:

-Based upon the average EV/Sales ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

A) $165 million.

B) $157 million.

C) $193 million.

D) $191 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Use the tables for the question(s)below.<br>Pro Forma

Q3: Use the table for the question(s)below.<br>Capital Structure

Q4: Use the table for the question(s)below.<br>Pro Forma

Q5: Use the tables for the question(s) below.<br><img

Q6: Use the tables for the question(s)below.<br>Pro Forma

Q7: Use the tables for the question(s)below.<br>Pro Forma

Q8: What is the purpose of the sensitivity

Q9: Use the table for the question(s)below.<br>Pro Forma

Q10: Use the following information to answer the

Q11: Use the tables for the question(s)below.<br>Pro Forma