Multiple Choice

Use the information for the question(s) below.

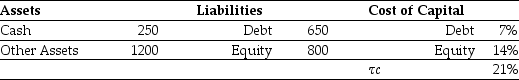

Iota Industries Market Value Balance Sheet ($ Millions) and Cost of Capital  Iota Industries New Project Free Cash Flows (Millions)

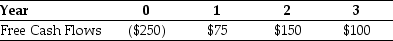

Iota Industries New Project Free Cash Flows (Millions)  Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio.

Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio.

-The NPV for Iota's new project is closest to:

A) $25.25 million.

B) $11.57 million.

C) $9.00 million.

D) $18.50 million.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Use the table for the question(s)below.<br>Consider the

Q3: Which of the following methods are used

Q4: Use the information for the question(s)below.<br>KT Enterprises

Q5: The assumption that the firm's debt-equity ratio

Q6: Which of the following statements is FALSE?<br>A)The

Q8: Use the information for the question(s)below.<br>Iota Industries

Q9: Consider the following equation: Dt = d

Q10: Use the information for the question(s)below.<br>Aardvark Industries

Q11: Use the information for the question(s)below.<br>Suppose that

Q12: Which of the following statements is FALSE?<br>A)The