Multiple Choice

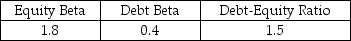

Use theUse the firm has only been listed on the stock exchange for a short time,you do not have an accurate assessment of Nielson's equity beta.However,you do have the following data for another firm in the same industry:  Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

-Nielson's equity cost of capital is closest to:

A) 11.3%.

B) 12.2%.

C) 14.0%.

D) 14.4%.

Correct Answer:

Verified

Correct Answer:

Verified

Q89: Use the information for the question(s)below.<br>Suppose Luther

Q90: Luther Industries is considering borrowing $500 million

Q91: Use the information for the question(s)below.<br>KT Enterprises

Q92: Use the information for the question(s)below.<br>The Aardvark

Q93: Which of the following is NOT a

Q94: Use the following information to answer the

Q95: Use the following information to answer the

Q97: Consider the following equation: rwacc = <img

Q98: Use the information for the question(s)below.<br>Aardvark Industries

Q99: Which of the following statements is FALSE?<br>A)In