Multiple Choice

Use the information for the question(s) below.

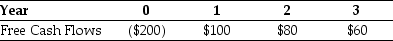

Aardvark Industries is considering a project that will generate the following free cash flows:  You are also provided with the following market value balance sheet and information regarding Aardvark's cost of capital:

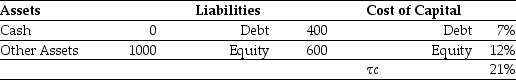

You are also provided with the following market value balance sheet and information regarding Aardvark's cost of capital:

-Suppose that to fund this new project,Aardvark borrows $120 with the principal to be paid in three equal installments at the end each year.The present value of Aardvark's interest tax shield is closest to:

A) $5.15.

B) $5.00.

C) $5.90.

D) $5.25.

Correct Answer:

Verified

Correct Answer:

Verified

Q55: Use the information for the question(s)below.<br>The Aardvark

Q56: Consider the following equation for the project

Q57: Consider the following equation: rwacc = <img

Q58: Which of the following is NOT one

Q59: Use the information for the question(s)below.<br>KT Enterprises

Q61: Use the information for the question(s)below.<br>Iota Industries

Q62: Which of the following is NOT a

Q63: Use the following information to answer the

Q64: Use the following information to answer the

Q65: Use the information for the question(s)below.<br>Omicron Industries'