Multiple Choice

Use the information for the question(s) below.

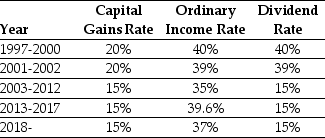

Consider the following tax rates:  *The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire after 2025 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 37% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a buy and hold individual investor in 1999 was closest to:

A) 25%.

B) 0%.

C) 20%.

D) 40%.

Correct Answer:

Verified

Correct Answer:

Verified

Q69: Use the information for the question(s)below.<br>Luther Industries

Q70: Use the following information to answer the

Q71: Which of the following statements is FALSE?<br>A)With

Q72: Use the information for the question(s)below.<br>Rockwood Industries

Q73: Taggart Transcontinental has announced a $2 dividend.If

Q75: Use the information for the question(s)below.<br>Consider the

Q76: Which of the following statements is FALSE?<br>A)Managers

Q77: Use the information for the question(s)below.<br>Consider the

Q78: Consider the following equation: Pretain = Pcum

Q79: Use the information for the question(s)below.<br>Omicron Technologies